Two deeply sub-investment-grade-rated banks turned to the private placement market to bolster their balance sheets with bail-in-able debt this month, circumventing the execution risk that can accompany widely marketed transactions, especially at this time of year.

Novo Banco and Alpha Bank have both sold senior debt in recent days using the method, enabling them to meet their regulatory requirements going into year-end.

"Another last-minute panic trade," said a syndicate banker of the Novo Banco deal. "Alpha Bank also did a €400m deal last week. They've basically been tapped on the shoulder by the regulator, who's asked them to get their MREL numbers in shape for year-end. It's the same story for Novo Banco. There have been a few issuers in recent months who've been told explicitly by the ECB, the EBA: you have to get this done, no matter what the cost is."

Novo Banco priced a €275m 4.25% 2NC1 senior preferred transaction via sole lead JP Morgan on Monday. In a statement, the bank said the notes were placed with institutional international investors and that the issuance was executed to comply with MREL requirements.

It followed Alpha Bank's 3% February 2024 callable in February 2023 sold by Morgan Stanley last week. Both notes carry deep sub-investment-grade ratings, at Caa2 and B3/B+, respectively.

"As such, that debt doesn't have much utility; it's very short, but that allows the borrowers to tick a box with the regulators," said the syndicate banker. "It'll be interesting to see what happens next year. They'll have the same problem and the market will know they need to refinance these deals."

The hope is that the credit story will have improved over time, enabling them to slash refinancing costs further down the line.

"If you only have a small gap and you raise a short-dated deal, it allows you to refi that at a better rate later, as long as your asset quality continues to improve and your spread trajectory is positive," said a second syndicate banker, adding that the level paid by Alpha was high, given where Piraeus had sold a longer deal in October.

"On that basis, you'll have the ability to call that later at a better spread and bridge the gap in the meantime. I don't consider these to be large refi burdens."

Still, these banks are a lot more exposed to volatility and have seen yields rise on their debt rapidly when the tone has turned sour.

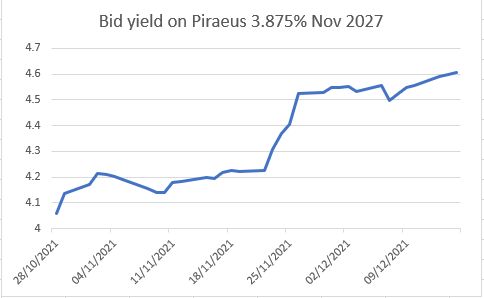

The €500m of MREL-eligible green senior preferred placed by Piraeus at 3.875% in October has sold off in the secondary market and was bid at a yield of 4.6% on Wednesday according to Tradeweb.

Source: Refinitiv Eikon

Looking for the additional buyer

While market access for sub-investment-grade banks has improved in recent years, enabling them to build their layers of loss-absorbing debt, it is not always straightforward, especially when sentiment turns and investors' search for yield is not as acute.

"These clean, or cleaner banks now have pretty good market access," the second syndicate banker said.

"But I think the problem the Greeks face is: how broad and how much capacity do you have to grow your investor base when you're so constrained ratings-wise? Not everyone is willing to deploy capital in Triple Cs that yield 2.5%, 3%. A lot of the European money is ratings-driven and they can only buy once the upgrade has happened. The headwinds faced by the Greeks, not just Alpha, as a collective set of banks because of the ratings drag is an issue. How do you grow that investor base to fulfil your stack over time?"

In the case of Novo Banco, the Portuguese lender continues to grapple with the legacy of a controversial 2015 debt transfer. It sold a €300m 3.5% 3NC2 senior preferred in July, though the deal was only marginally oversubscribed and ultimately priced in line with initial guidance.

That transaction was aimed at starting the bank's build-up of MREL-eligible debt after it received its regulatory targets in June, with a concurrent tender offer and consent solicitation for the bank's legacy senior bonds designed to normalise its capital structure. It was bid at 4.5% on Tuesday, according to Tradeweb.