Barclays is preparing to price its first dollar credit card securitization since 2019 as the bank has been inking deals to expand its card business.

The British bank on Monday announced a self-led Triple A-rated single-class transaction, which has weighted-average life of 2.98 years, Barclays Dryrock Issuance Trust 2021-1. The SEC-registered note is sized at US$500m and could be increased. The deal is expected to price on Wednesday.

Barclays last priced a credit card ABS from its Dryrock shelf in August 2019, when it raised US$650m. The Dryrock trust is backed by receivables generated by Barclays' general card programs and co-branded ventures with companies such as American Airlines and cruise line operator Carnival.

The deal comes as Barclays and other banks have been looking for ways to grow their fee-generating businesses such as credit cards in the low-rate climate and while commercial loan growth has been modest since the pandemic.

On August 27, Barclays said its US unit will purchase a US$3.8bn credit card portfolio from Synchrony Bank whose receivables were generated from a venture between Synchrony Bank and clothing chain The Gap. This move followed a deal in April struck between Barclays and Gap in which they would issue co-branded credit cards to Gap customers in 2022.

The bank's credit card master trust does not currently have receivables from the Gap-Synchrony transaction, which is scheduled to close in the second quarter of 2022.

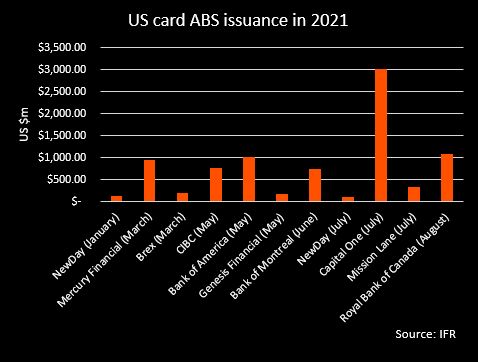

To support greater card activity and their existing card securitization programs, banks have increased their ABS issuance this year, halting a declining trend that has been driven by cheap deposits and regulatory capital concerns.

New issuers have also been tapping the ABS market for funding. Fintech firm Avant is readying its inaugural credit card securitization in the coming days, a source familiar with the deal said.

Credit card ABS supply has risen to US$8.43bn so far this year, more than double the US$3.8bn total recorded in 2020, according to IFR.

Investor appetite for securitized card paper has been strong due to their high credit quality and relative scarcity. Average secondary spreads on three-year fixed-rate Triple A card ABS are running at swaps plus 2bp, unchanged from a week ago, according to JP Morgan.

There are currently four outstanding card ABS transactions issued from the Dryrock trust, which had US$5.9bn in receivables as of June 30, Fitch said a presale report.