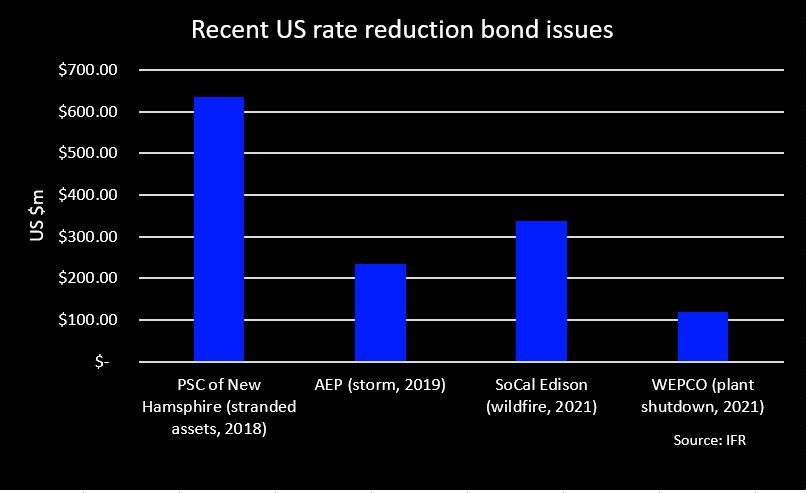

Wisconsin Electric Power Company is looking to issue an ABS deal next week to finance the dismantling of a coal-fired power plant following a similar deal from Southern California Edison in February that was received well by investors.

The single-class, Triple A rated transaction, WEPCo Environmental Trust Finance I 2021, is expected to raise US$118.81m and will be secured by a special fee the utility will collect from its customers. Barclays is the lead underwriter.

In November 2020, the Wisconsin state legislature approved the bond issuance for WEPCO to recover US$100m of the undepreciated costs associated with the environmental control activities at the Pleasant Prairie Power Plant.

This kind of securitization can lower the cost to customers on a present value basis compared with other methods of financing. In a pre-sale report, Fitch estimated the net present value benefits from securitization were around US$41m compared with traditional utility ratemaking.

On a weighted average basis across all customer classes, the initial "environmental control charges" is expected to be 0.051 cents per kilowatt-hour or 0.37% of the customer bill, the rating agency said.

This type of bond was introduced more than two decades ago for utilities to recover past investments in power plants or long-term electric contracts as the industry was undergoing deregulation.

Issuance of these ABS had powered down considerably in recent years. Before this year, there had only been two issues, totaling US$871m, priced from 2017 to 2020. American Electric Power accounted for one issue, the US$235m AEP Texas Restoration Funding 2019-1 and Eversource's Public Service Company of New Hampshire sold a US$636m issue, PSNH Funding LLC 3 2018-1.

Issuance could be set to increase, however.

In February, SoCal Edison issued a a US$337.78m deal, SCE Senior Secured Recovery Bonds Series 2021, to recoup costs from previous wildfires and fund efforts to prevent future ones. Other California utilities are expected to bring their own ABS deals later this year for the same purpose, bankers said.

There has also been market chatter whether Texas may allow the state's utilities to use this type of ABS to recover costs relating to the deadly winter storm in February. The state approved American Electric Power to collect and securitize a special fee from its customers to recoup clean-up costs stemming from Hurricane Harvey in 2017.

Given their scarcity and top-notch ratings, rate reduction bonds have performed well in the secondary market. The average spread on three-year rate reduction ABS is running at 13bp over swaps, which is 17bp tighter since the start of the year and is comparable to prime auto ABS of similar rating and tenor, Bank of America data show.