Domino's Pizza is preparing this week its first whole business securitization since 2019 to refinance two maturing notes, totaling US$873m.

The Ann Arbor, Michigan-based company has hired Guggenheim Securities and Barclays Capital to underwrite the offering, the US$1.5bn Domino's Pizza Master Issuer LLC 2021-1, which is expected to be rated BBB+ by S&P.

The deal features two term notes, each with a minimum size of US$500m. The A-2-I note has a weighted average life of 7.3 years, while the A-2-II has a 9.5-year WAL.

The transaction may be enlarged to US$1.85bn.

Some of the proceeds will be used to prepay and retire in full about US$291m of a DPABS 2017-1 floating-rate Class A-2-I senior secured notes and US$582m in a fixed-rate 3.082% senior secured note from the same deal, the company said on Monday.

The rest of funds are earmarked for general corporate purposes, including distributions to common shareholders and/or stock repurchases, the company said in a statement.

The deal also establishes a new US$200m variable funding note facility, which will replace the existing US$200m one.

The world's biggest pizza chain is expected to clinch lower borrowing costs for than its 2017 offering after the Federal Reserve cut short-term interest rates near zero a year ago to avert a deep recession due to the pandemic, according to ABS bankers.

Domino's is the first of several fast food WBS issuers that may bring refinancing deals in the coming months as some of their older notes are set to mature later this year and early 2022, market sources said.

In addition to Domino's, burger chain Wendy's, doughnut maker Dunkin Brands and Mexico food eatery Taco Bell also have WBS notes that are callable this year. Collectively, they could serve up to US$5bn in WBS issuance this year, one ABS banker said.

"A lot more outstanding tranches are entering their par call window this year compared to 2020," another banker said.

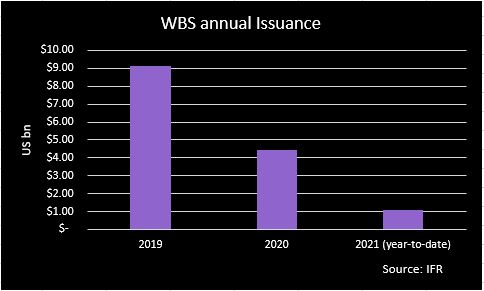

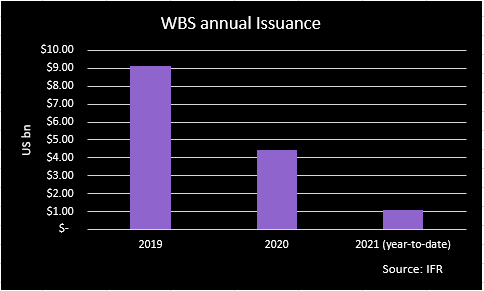

Since January, WBS issuance has reached only US$1.06bn from two service franchisers, Servpro and Neighborly. In 2020, WBS supply totaled US$4.4bn, down from the record annual total of US$9.1bn the year before, IFR data show.

On March 3, cleaning and restoration franchiser Servpro priced a US$260m WBS note, Servpro Master Issuer LLC 2021-1 at a 2.394% coupon.

Fast food WBS issues are expected to draw strong investor demand as quick restaurants' revenues have rebounded from initial drop due the Covid crisis. Domino's same-store sales have grown 11.5% domestically and 4.4% internationally in the past year, company data show.