Going big

The coronavirus pandemic helped return structured equity to issuance highs. Morgan Stanley was there financing growth with many of the biggest deals of the year. Morgan Stanley is IFR’s EMEA Structured Equity House of the Year.

So often a niche product, convertible and exchangeable bonds were hot in 2020 as companies sought to cope with – or capitalise on – the coronavirus pandemic. In the EMEA region, that translated into annual issuance volume nearly doubling to US$35.5bn, up from US$18bn in 2019.

Suddenly the market grew beyond the mid-cap issuers that have been its relatively unexciting bread and butter for years.

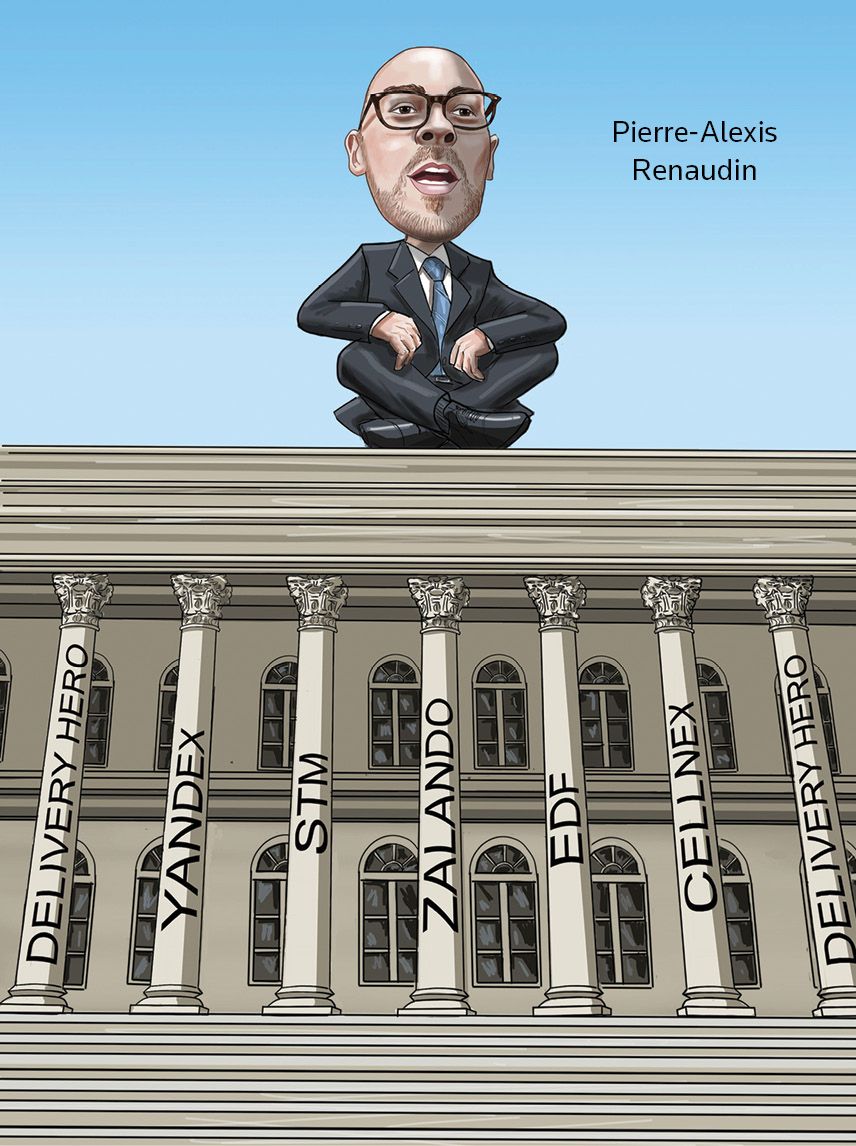

Morgan Stanley has always focused on bigger deals, leading to the joke that its head of equity-linked in the region, Pierre-Alexis Renaudin, wouldn’t get out of bed for less than US$1bn. In 2020, the bank nearly trebled its number of deals, and its total – US$16.1bn of proceeds across 17 transactions – was within touching distance of that US$1bn average.

It was, as head of EMEA ECM Martin Thorneycroft recounts, “way beyond our wildest expectations on January 1”.

And yet a pandemic year could have seen Morgan Stanley go backwards as equity-linked is a market that tends to favour lending banks.

“[In 2020] how many convertible bonds did we do that were used to refinance loans of a company? Zero – not a single one,” said Renaudin. “Every transaction that we’ve done was opportunistic, for growth, or M&A.”

In other words, all the mandates had to be won and the transactions were to the clear benefit of the issuers.

Sole-bookrunner mandates are rare in equity-linked, but Morgan Stanley provided exclusive advice for both a €150m seven-year CB in July from BE Semiconductor Industries of the Netherlands and Russian internet group Mail.ru’s US$600m 3% capital increase and five-year CB combo in September. It was also effectively sole on Sappi’s R1.8bn (US$117m) five-year as the pulp and paper business hired Morgan Stanley and its South African partner RMB.

As with the majority of Morgan Stanley’s equity-linked trades, the deal priced at the mid-point, showing a balance between providing the right advice to clients and accurately judging investor appetite. “Every time we price at the mid-point, it is vindication that we pushed terms as far as we could and the client knows that we did not leave money on the table,” said Renaudin.

In a year where vanilla CB structures were preferred, it was essential to bring the right names to market at the right time. BESI’s July issue had to be co-ordinated around publication of its second-quarter results and the US$1.5bn issuance of seven-year zero coupon dual-tranche CBs in the same sector from STMicroelectronics that morning. Morgan Stanley was involved in both, though junior on the STM trade.

With an intraday launch scuppered, BESI shifted to a post-close launch, allowing for momentum from company results to build and time for wall-crossing. A conversion price more than 24% above the record stock close was the consequence.

One of the few trades before the market sell-off was a €400m seven-year CB for French care homes operator Korian that launched in a tiny window at the start of March, shortly after the Fed’s announcement of a 50bp rate cut.

In fact, Morgan Stanley had reopened the market in the first weeks of January, moving quickly to print an upsized €1.75bn CB alongside €571.1m of equity for Delivery Hero to fund its acquisition of South Korea’s Woowa Brothers earlier than anticipated after a 40% tear in the stock.

Delivery Hero was still able to pull in more than €4bn of orders for a further €1.5bn of dual-tranche CBs in July, despite no use of proceeds commitment as it looked to take advantage of investment opportunities. At that point, Delivery Hero accounted for nearly a quarter of European equity-linked issuance for the year.

Cellnex Telecom was another repeat client, printing a €1.5bn CB in November, less than three months after pulling in €4bn for a rights issue and also doing it without a defined use of proceeds. Not only did the new paper push on maturity – with the 11-year tenor the longest achieved in EMEA since 2007 – a premium redemption feature allowed for an effective conversion premium of 82.5%. That premium was captured completely as the delta placing priced flat to the close.

Along with pushing on tech names, the core innovation for 2020 and beyond was ESG, which came of age with EDF’s €2.4bn four-year CB in early September, the largest green CB globally by far and the biggest non-mandatory in Europe since 2003.

“Investors were waiting for green paper and the key was about taking little steps to get it to work, not overdo it or make it overly complicated,” said Renaudin.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@lseg.com