Consensus builder

Urjit Patel, the new head of the Reserve Bank of India, is viewed as a harmonising figure. His first challenge: to clean up the country’s public banks, and get them to lend again.

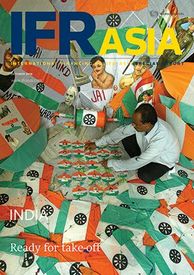

It has taken some deep surgery, but India’s capital markets are at last on a much stronger footing. Now that regulators have done their part, it is up to investors and business leaders to take the economy to the next level. From one of the ‘fragile five’ a few short years ago, India has become a standout among the world’s emerging markets. Equities are up handsomely this year, the currency has stabilised, and foreign investors are circling. Much of this is down to policy measures – both at the government and the central bank. Narendra Modi’s...Read more

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com and shahid.hamid@lseg.com

Urjit Patel, the new head of the Reserve Bank of India, is viewed as a harmonising figure. His first challenge: to clean up the country’s public banks, and get them to lend again.

India’s bank capital gap is coming down, but for the wrong reasons. Banks are putting the brakes on lending instead of raising equity and holding onto unrealistic price expectations in the offshore bond market.

State Bank of India is contemplating a range of funding options after setting onshore and offshore benchmarks for Indian bank capital.

India’s equity markets are emerging as a bright spot in a challenging Asian landscape, as investors look to diversify away from China and more companies seek growth capital.

HDFC’s landmark offshore rupee issue finally unlocked the Masala bond market in July, but familiar concerns over pricing, liquidity and regulation threaten to cast a shadow over its long-term development.

Cheap credit and regulatory reforms are luring Indian companies to the revived domestic bond market, taking market share from the capital-constrained banking sector.

As India sets about becoming a leader in clean energy, capital markets are stepping up to the plate to make up for waning bank credit and the lack of a dedicated investor base.

Sweeping regulatory changes are giving banks new powers to enforce recoveries on non-performing assets, breaking with a culture of routine deferments and debtor unaccountability.