US$50bn funding blitz shows Oracle’s market access – and its vulnerability

Oracle has moved to retake control of its narrative after a brutal few months that wiped half a trillion dollars from its valuation, with the launch of a US$50bn financing package aimed at demonstrating its access to capital to dispel concerns about its rapidly rising debts.

Electronic revolution hits banks’ credit trading revenues

Banks’ corporate bond trading revenues have slumped to their lowest level in more than a decade, according to benchmarking firm BCG Expand, in the wake of a rapid electronification of these markets that is eroding the profitability of credit trading desks.

Rupak Ghose

The AI boom has been backed by investor enthusiasm – and their money – on an unprecedented scale. Investment bankers have high hopes of a huge year for deals. But just like the broader economy, will this be a K-shaped market for tech deals?

SpaceX has acquired its sister company xAI for US$250bn, in a deal that will provide some much-needed financial support to the lossmaking AI and social media platform – but which could complicate the rocket maker’s plans to launch the world’s biggest ever IPO in June.

US boutique investment banks closed out 2025 with the wind at their backs, setting revenue records in the quarter and for the year.

UBS has increased its returns target for 2028 after delivering bumper annual results as its takeover of Credit Suisse continues to bear fruit and it delivered record fourth-quarter trading revenues, up 17% from a year earlier.

Oracle stepped back into the US high-grade market on February 2 to raise US$25bn as part of a larger US$50bn debt and equity financing as the enterprise software company sought to hold on to its investment-grade rating amid massive fundraising efforts to build out its AI business.

Poland successfully printed one of the largest international yen bond deals on Friday, even though the market was on tenterhooks ahead of Japan's February 8 snap elections.

India has unveiled fresh incentives to spur municipal bonds and deepen the corporate bond market, while proposing to set up a risk guarantee fund to support infrastructure lending.

FIG issuers went big in senior unsecured markets in the first week of February, with many bringing multi-tranche deals to capitalise on market conditions that some participants say are too good to last.

A Blackstone joint venture is in the securitisation market with a US$3bn offering to refinance the Cosmopolitan casino on the Las Vegas Strip that it purchased in 2022.

Nearly €1.7bn of RMBS priced in the past week, with the deals from Domivest, ING and Dilosk attracting strong demand.

Australian digital financial services company Zip broke new ground with its 12th buy now, pay later consumer loans ABS issue, the A$300m (US$210m) Zip Master Trust Series 2026-1, which was priced on January 30.

General Motors on Tuesday kickstarted the month's US asset-backed issuance, hot on the heels of a solid January that saw more than US$27bn of supply.

The stalled sovereign debt-for-development swap market is set for its first deals in more than a year after a notable new player created by DFD pioneer Ramzi Issa signed up a leading speciality insurer to back its transactions.

The UK's Transition Finance Council is getting ready to publish overarching global guidelines to assess the credibility of companies and groups' transition plans as the architecture to scale up transition finance continues to move into place.

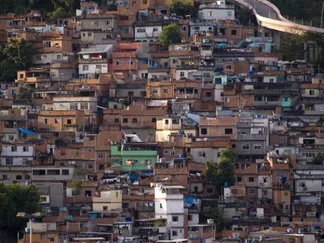

CAF – Development Bank of Latin America and the Caribbean has become the first borrower to apply the United Nations Children’s Fund’s Child-Lens Investing Framework to its bond issues. Launched in September 2023 and updated the following year, the framework aims "to advance positive child outcomes while also minimising child harm".

Seeds and crop protection giant Syngenta Group met banks last week to pick IPO arrangers for what could be the largest listing in Hong Kong in seven years.

Liftoff Mobile pulled its up to US$762m Nasdaq IPO on Thursday evening in the wake of the week's selloff of software stocks due to investor concerns about the threat to the sector from AI.

Amid an unprecedented AI-focused borrowing binge, Oracle became the first of the hyperscalers to blink on the public equity side, raising US$5bn from the sale of a mandatory convertible preferred, while filing to sell another US$20bn of stock on the open market through an at-the-market programme.

Asia's equity-linked issuance has got off to a rapid start this year, with 15 deals raising US$9.9bn on strong investor appetite for the product.

Underwriting banks have been forced to fund the debt backing Conga’s acquisition of the business-to-business division of Pros Holdings amid a sharp selloff in software stocks as investors raised concerns about the borrower’s AI exposure.

Private credit funds' significant exposure to the software industry, once seen as a relatively safe bet, has become a potential landmine as investors grow increasingly concerned that artificial intelligence could disrupt software companies’ business models and undermine the loans backing those investments.

As foreign financiers increase their involvement in leveraged finance in Japan, the market practices and terms they bring with them are shaking up the country's traditionally conservative lending landscape.

Private equity firms are ramping up their focus on the aerospace and defence sector as global military spending accelerates, creating new financing opportunities for European direct lending and syndicated loan markets, which have historically lagged the US in underwriting defence-related credits.

Read the latest stories from the magazine IFR 2619 - 7 Feb 2026 - 13 Feb 2026

7 Feb 2026 - 13 Feb 2026